Looking to estimate your future entitlements?

(If you are not currently enrolled in the alternating work-retirement program, a separate forecasting tool is available through your personal account).

Below is the tutorial CRPN has put together to help you get the most out of our alternating work-retirement pension estimator.

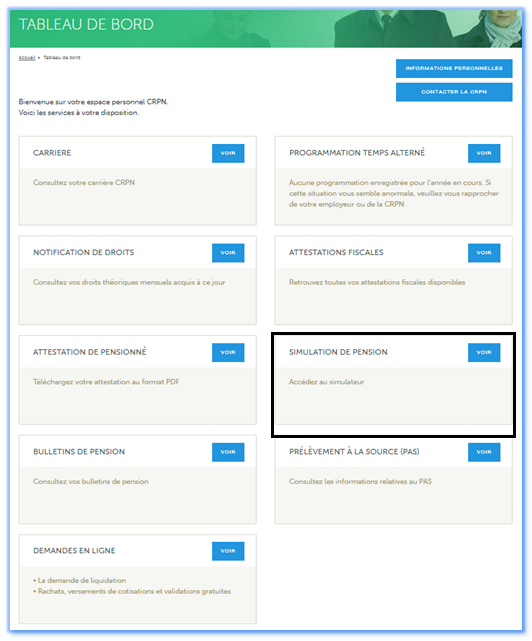

Just log in to your personal account, go to the dashboard, and click on Forecast your pension.

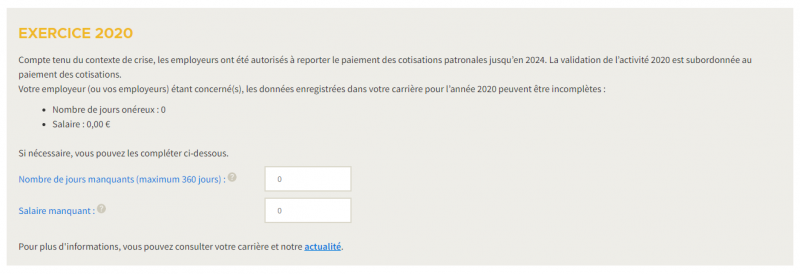

EXERCICE 2020

If your employer used the deferred contribution payment facility following the Covid-19 crisis, you can perform a simulation of the missing 2020 times and salaries in your career record in the dedicated section:

To reconstitute your missing 2020 salary in your career record, you must add together the salaries subject to CRPN contribution of all payslips for the year 2020 for the employers concerned.

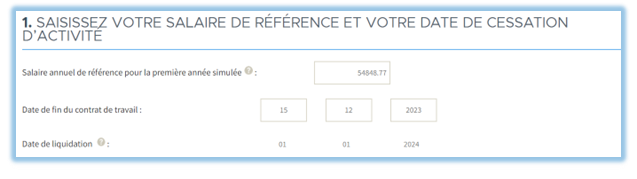

STEP 1

When you start the estimator, it will automatically display the salary for the last year that has been posted to your career. However, you can also choose to replace this default value with the salary value of your choice.

In step 1, you will also need to enter the date on which you expect your employment contract to end. The estimator will automatically calculate the date of your pension claim as the 1st day of the month following the date on which your employment contract ended, and step 2 will display instantly.

STEP 2

Step 2 sets out your current and forecast career.

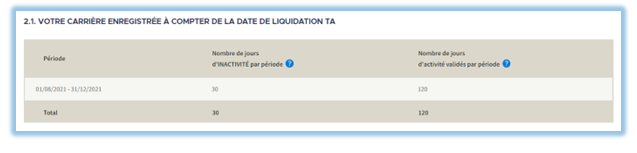

2.1: a year-by-year breakdown of the following career information that has posted to your account since the date of your enrollment in the alternating work-retirement program:

Information

- Number of days off work: this number is calculated by subtracting the number of days posted to your account for the period from the total number of days which the period can contain.

- Number of “on” days validated:, i.e. the days of work that have been posted to your career from the date of your enrollment in the alternating work-retirement program up to today (last column).

Example: For a claim effective September 1st, 2014, the portion of the year 2014 that falls after the date of your claim through the alternating work-retirement program (i.e. from September 1st through December 31st) is 120 days long. In the case illustrated above, as 59 “on” days, or days of work, have been credited to the member’s account, the estimator calculates 61 days off work.

For a full year, the total of both columns adds up to 360 days.

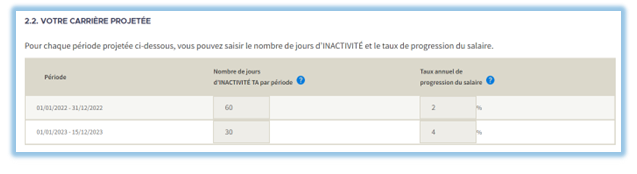

2.2: a year-by-year breakdown of your forecast career

If applicable, you can enter the following information for each of the years on the list:

- The number of days OFF WORK that you are planning to schedule,

- Along with any expected pay raise.

Click on the “Estimate your future pension” button.

STEP 3

The results section is broken down into 3 parts:

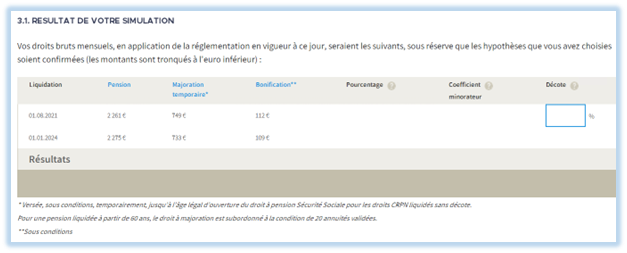

3.1: your pension forecast results

A member’s final pension consists of two parts,

- The first portion is calculated based on entitlements claimed through the alternating work-retirement program,

- The second portion is calculated based on all remaining pension entitlements.

The percentage assigned to each of these claims is calculated on the assumption that pension was paid for all days off work.

Part 3.3 lets you change your number of days assumed as paid.

The result line shows your final pension amount.

If the 1st portion of your entitlements (claimed through the alternating work-retirement program) was assigned a rate reduction, you will need to enter your rate reduction into the appropriate box (your rate reduction percentage appears on your certificate of pension entitlement through the alternating work-retirement program) and hit Enter to recalculate your amounts.

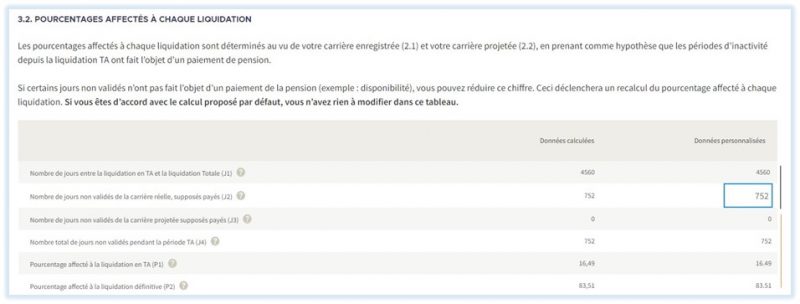

3.2:the percentages assigned to each claim

The percentage assigned to each of your pension claims is calculated on the assumption that pension was paid for all days off work.

If you believe that the total number of days off work that you were paid is less than the number of days that displays in the box, you can change the number of “days assumed paid” on line J2.

If you change this line, the percentage assigned to each claim will be recalculated, which will then result in your total pension result being recalculated (as shown in section 3.1).

Additional information

Black vertical line : career posted to your CRPN account/ Orange vertical line : forecast career

In the example above, on line J2:

662 days have not been posted to your career,

12 days belong to a period of unpaid leave on which no pension was paid. You have only drawn 650 days of pension.

Please enter this number of days in the “Personalized information” column in our estimator.

To learn how pensions through the alternating work-retirement program are calculated, please refer to our factsheets “Retiring through the alternating work-retirement (prior to January 1st, 2019)” and “Retiring through the alternating work-retirement program (on or after January 1st, 2019)“.